Pocket Option AML Policy: Ensuring Compliance and Security in Trading

This article delves into the Pocket Option AML Policy Patakaran sa AML at KYC Pocket Option and its pivotal role in the financial landscape, aiming to ensure safety and integrity within trading environments. The Anti-Money Laundering (AML) policy is not merely a legal obligation; it is an essential component for maintaining trust between traders and service providers.

Understanding AML Policies

Anti-Money Laundering (AML) policies are regulations put in place to prevent illicit activities, including money laundering and terrorism financing. By scrutinizing transactions and identifying suspicious activities, firms can uphold the integrity of the financial system. These policies are particularly critical in industries such as online trading, where large sums of money are frequently transferred and anonymity can be exploited for criminal purposes.

Significance of the Pocket Option AML Policy

The Pocket Option AML policy is designed to fulfill legal requirements and promote responsible trading practices. Here are some key points highlighting its significance:

- Compliance with Regulations: Pocket Option conforms to international standards and regulations set forth by governing bodies, ensuring that their operations adhere to legal and ethical guidelines.

- Protection Against Financial Crimes: The AML policy acts as a safeguard against fraud, money laundering, and other financial crimes, thereby protecting both the company and its clients.

- Building Trust: A robust AML framework fosters trust between traders and the platform, as it demonstrates Pocket Option’s commitment to maintaining a secure and respectful trading environment.

- Risk Mitigation: By identifying and mitigating potential risks associated with illegal activities, the policy reduces the likelihood of financial losses and reputational damage.

Key Components of the Pocket Option AML Policy

The Pocket Option AML policy consists of various essential components, each designed to enhance security and compliance. Some of these key elements include:

1. Client Verification (KYC)

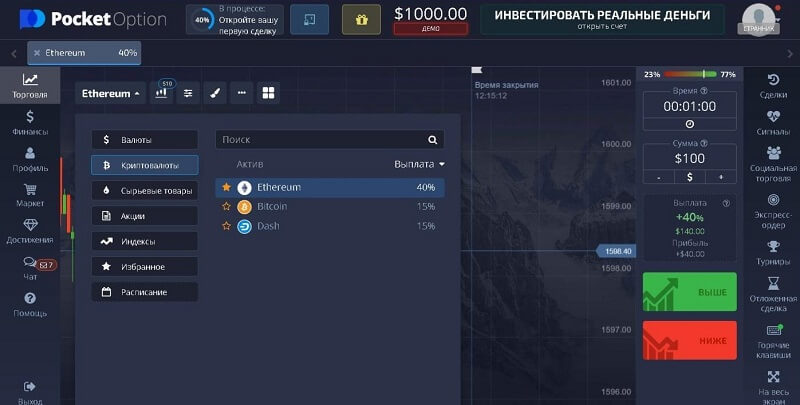

Know Your Customer (KYC) is a crucial process that involves verifying the identity of clients before they engage in trading activities. This includes collecting personal information, such as government-issued IDs, proof of address, and other relevant data. The primary objective of KYC is to ensure that Pocket Option only serves legitimate clients and to minimize the risk of fraudulent activities.

2. Monitoring Transactions

Continuous surveillance of transactions is a vital part of the AML policy. By monitoring trading activities, Pocket Option can quickly identify any unusual patterns or transactions that may indicate money laundering or other illicit activities. This proactive approach enables swift intervention, ensuring that the platform remains safe for all users.

3. Reporting Suspicious Activities

When suspicious activities are detected, the Pocket Option AML policy mandates the reporting of such instances to the relevant regulatory authorities. This is a critical component of compliance, as it reinforces accountability and transparency within the trading ecosystem.

4. Employee Training

To ensure that all staff members understand the importance of AML compliance, Pocket Option provides training to its employees. Such training helps employees recognize potential threats and equips them with the necessary skills to implement the AML policy effectively.

Impact of AML Policies on Trading

The implications of effective AML policies extend beyond mere compliance; they shape the overall trading experience. Here are some beneficial impacts of Pocket Option’s AML policy:

1. Enhanced Security

In a world where cyber threats are prevalent, the implementation of stringent AML measures significantly enhances the security of the trading platform. This peace of mind allows traders to focus on their investment strategies without worrying about potential illicit activities affecting their accounts.

2. Improved Reputation

For companies like Pocket Option, a strong AML policy bolsters their reputation in the competitive trading market. Trust is a currency in finance, and by prioritizing compliance, Pocket Option earns the goodwill of its user base, which expands as more traders seek reputable platforms.

3. Long-term Viability

By establishing a culture of compliance and accountability, the Pocket Option AML policy supports the long-term viability of the company. Failing to address AML responsibilities can lead to severe penalties and operational challenges that may threaten the sustainability of the business.

Conclusion

In summary, the Pocket Option AML policy is a foundational element of its operations, instrumental in safeguarding traders and ensuring compliance with regulatory requirements. By implementing comprehensive measures such as client verification, transaction monitoring, and employee training, Pocket Option is dedicated to creating a secure trading environment that promotes trust and fosters responsible trading practices. As the financial landscape continues to evolve, the importance of robust AML policies will remain paramount in protecting both traders and the integrity of the financial markets.

For more information on Pocket Option’s commitment to security and compliance, visit the official Patakaran sa AML at KYC Pocket Option page.