Pocket Option Strategy: Navigating the World of Online Trading

In the realm of online trading, having a solid Pocket Option Strategy среднесрочная стратегия Pocket Option can be the key to achieving consistent profits. As the popularity of binary options trading has surged, traders are finding innovative ways to enhance their strategies. This article will explore essential elements of successful trading, dissecting various strategies that can be employed on the Pocket Option platform.

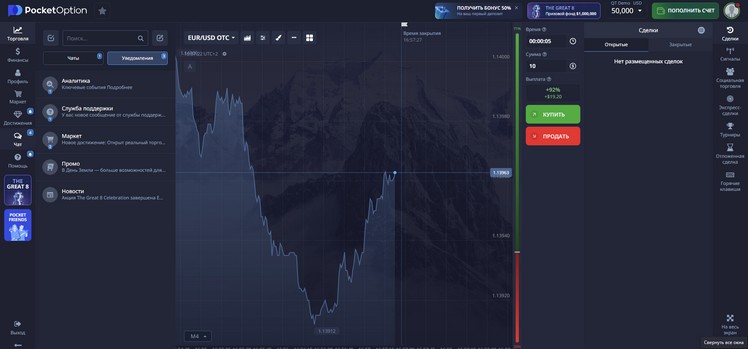

Understanding Pocket Option

Pocket Option has gained recognition as a user-friendly binary options trading platform. Its appeal lies in the simplicity of execution and a wide range of assets available for trading, including currencies, commodities, indices, and stocks. The platform offers features such as demo accounts and various trading tools, making it suitable for both beginners and experienced traders.

The Importance of Strategy

In trading, a well-defined strategy is crucial. It helps traders establish clear guidelines on when to enter and exit trades, how much to invest, and how to manage risk. Without a strategy, trading becomes a gamble rather than a calculated business decision. Pocket Option allows traders to develop and refine their strategies using various analytical tools and indicators.

Types of Strategies for Pocket Option

1. Trend Following Strategy

One classic approach in trading is the trend-following strategy, which assumes that a market trend (up or down) is likely to continue rather than reverse. Traders often use indicators like Moving Averages to identify trends. With Pocket Option, traders can utilize these indicators to gauge the market’s direction and make informed trading decisions.

2. Reversal Strategy

The reversal strategy aims to identify points where the market might change direction. Traders look for overbought or oversold conditions, which often indicate a possible reversal. Implementing indicators like the Relative Strength Index (RSI) or Stochastic Oscillator can help traders identify these conditions effectively.

3. News Trading Strategy

Economic news and events significantly impact financial markets. Traders employing a news trading strategy closely follow economic indicators and announcements, making trades based on anticipated market reactions. This strategy requires a good understanding of both the news cycle and how it affects different assets.

4. Scalping

Scalping involves making small profits from quick trades, typically holding positions for a few seconds to minutes. This strategy is ideal for traders who enjoy fast-paced action and can make rapid decisions. Scalpers take advantage of small price movements, and platforms like Pocket Option facilitate this with minimal trade execution delays.

Tools and Indicators for Pocket Option

To enhance trading strategies, traders can utilize various tools and indicators provided by Pocket Option. Here are some popular ones:

1. Moving Averages

Moving Averages help smooth price data to identify trends over a particular period. They can signal potential entry and exit points based on crossovers.

2. Bollinger Bands

Bollinger Bands consist of a middle band (SMA) and two outer bands. Traders use these bands to assess volatility and overbought or oversold conditions.

3. RSI (Relative Strength Index)

RSI measures the speed and change of price movements. It ranges from 0 to 100 and helps traders identify overbought or oversold conditions.

4. Stochastic Oscillator

The Stochastic Oscillator compares a particular closing price of an asset to its price range over a specified time period. It provides signals about momentum and possible reversals.

Risk Management

Effective risk management is crucial for success in trading. Traders should never invest more than a small percentage of their trading capital in a single trade. Setting stop-loss orders is also essential to limit potential losses. Moreover, maintaining a balanced trading portfolio can help mitigate risks associated with market volatility.

Psychology of Trading

The psychological aspect of trading can greatly influence decision-making. Emotions like fear and greed can lead to impulsive actions that deviate from one’s strategy. Maintaining discipline and sticking to the trading plan is essential for long-term success. Journaling trades can help traders reflect on their decisions and improve their strategies over time.

Conclusion

In conclusion, a well-structured Pocket Option strategy combined with effective risk management and an understanding of market psychology can significantly enhance trading success. Traders should invest time in developing their strategies and continuously refine them based on market conditions and personal performance. As with any endeavor, patience and persistence are fundamental in mastering the art of trading.